Fee for Technical Services: Detailed Analysis

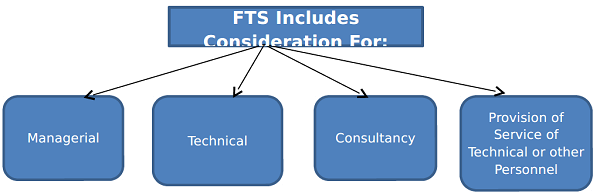

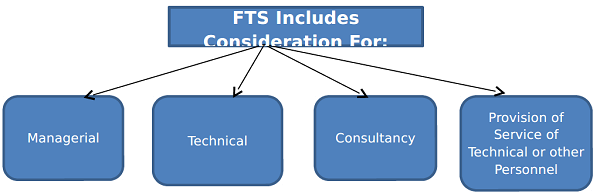

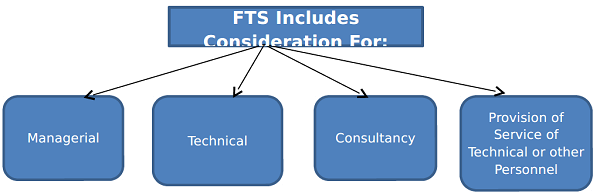

As per Explanation 2 to Sec – 9(1)(vii), “fees for technical services” means any consideration (including any lump sum consideration) for the rendering of any managerial, technical or consultancy services (including the provision of services of technical or other personnel) but does not include consideration for any construction, assembly, mining or like project undertaken by the recipient or consideration which would be income of the recipient chargeable under the head “Salaries”.

As per UN Model Tax Convention, 2017

The term “fees for technical services” as used in this article means any payment in consideration for any service of a managerial, technical or consultancy nature, unless the payment is made:

(a) to an employee of the person making the payment;

(b) for teaching in an educational institution or for teaching by an educational institution; or

(c) by an individual for services for the personal use of an individual.

Illustrative Treaties

Indo-UK Treaty

As per Para – 4 of Article – 13, the term “fees for technical services” means payments of any kind of any person in consideration for the rendering of any technical or consultancy services (including the provision of services of a technical or other personnel) which:

a) are ancillary and subsidiary to the application or enjoyment of the right, property or information for which a payment described in paragraph 3(a) of this article is received or

b) are ancillary and subsidiary to the enjoyment of the property for which a payment described in paragraph 3(b) of this Article is received or

c) Make available technical knowledge, experience, skill know-how or processes, or consist of the development and transfer of a technical plan or technical design.

Indo-US Treaty

As per Para – 4 of Article – 12, fees for included services” means payments of any kind to any person in consideration for the rendering of any technical or consultancy services (including through the provision of services of technical or other personnel) if such services :

a) are ancillary and subsidiary to the application or enjoyment of the right, property or information for which a payment described in paragraph 3 is received ; or

b) Make available technical knowledge, experience, skill, know-how, or processes, or consist of the development and transfer of a technical plan or technical design.

Analysis of above provisions

- There should be rendition of services.

- It also includes provision of services of technical and other personnel

- The terms managerial, technicaland consultancy are not defined anywhere in the Income Tax Act, 1961. In the absence of definition under Income Tax Act the common and general meaning of these terns should be taken into consideration (GVK Industries Ltd. [2015] 371 ITR 453 (SC)).

As per Dictionary – Consultation means an act of asking for “advice or opinion” of someone.

As per SC observed that consultation means a meeting in which a party consults or confers and eventually it results in human interaction that leads to rendering of advice.

As per Delhi ITAT in Le Passage to India Tours & Travel (P) Ltd. [2014] 369 ITR 109, it is held that not all kinds of advisory qualify as technical services. For any consultancy to be treated as technical services, it would be necessary that a technical element is involved in such advisory. Thus, the consultancy should be rendered by someone who has special skills and expertise in rendering such advisory.

- It does not include consideration for construction, assembly, mining or like projectsundertaken by the recipient or consideration which would be income of the recipient chargeable under the head salaries.

- The ordinary meaning of the term “management”involves the application of knowledge, skill or expertise in the control or administration of the conduct of a commercial enterprise or organization. Thus, if the management of all or a significant part of an enterprise is contracted out to persons other than the directors, officers or employees of the enterprise, payments made by the enterprise for those management services would be fees for technical services within the meaning of paragraph 3 (UN-MCC). Similarly, payments made to a consultant for advice related to the management of an enterprise (or of the business of an enterprise) would be fees for technical services.

- Management in organizations include at least the following: (i) discovering, developing, defining and evaluating the goals of the organization and the alternative policies that will lead towards the goals; (ii) getting the organization to adopt the policies; (iii) scrutinizing the effectiveness of the policies that are adopted; (iv) initiating steps to change policies when they are judged to be less effective than they ought to be.

- The expression “managerial service” needs to be considered in a commercial parlance. It has been interpreted as follows:

- It signifies service for management of affairs or services rendered in performing management functions.

- It involves controlling, directing or administering the business.

- It means managing the affairs by laying down certain policies, standards and procedures and then evaluating the actual performance in light of the procedures so laid down

- Management – Management in an organization includes at least the following: (a) discovering, developing, defining and evaluating the goals of the organization and the alternative policies that will lead towards the goals; (b) getting the organization to adopt the policies; (c) scrutinizing the effectiveness of the policies that are adopted; and (d) initiating steps to change policies when they are judged to be less effective than they ought to be management thus pervades all organizations. (J.K (Bombay) Ltd. v/s CBDT [1979] 118 ITR 312)

- The term managerial services, ordinarily means handling management and its affairs. As per the concise oxford dictionary, the term managerial services means rendering of services which involves controlling, directing, managing or administering a business or part of a business or any other thing. (Endemol South Africa (Proprietary) Ltd. vs DCIT [2018] 98 taxmann.com 227 (Mum ITAT))

- The word technical is involving or concerning applied and industrial sciences. Consultancy is generally understood to mean advisory services. Further, it may be fair to state that not all kind of advisory could qualify as technical services. For any consultancy to be treated as technical services, it would be necessary that a technical element is involved in such advisory. Thus, the consultancy should be rendered by someone who has special skills and expertise in rendering such advisory. (Skycell Communication Ltd. vs DCIT [2001] 251 ITR 53)

- The term ‘technical services’ takes within its sweep services which would require the expertise in technology or special skill or knowledge relating to the field of technology. As per the concise oxford dictionary, the term ‘technical services’ means belonging or relating to art, science, profession or occupation involving mechanical arts and applied sciences. As the administrative services, viz., arranging for logistics, etc., by the assessee did neither involve use of any technical skill or technical knowledge, nor any application of technical expertise on its part while rendering such services, the same cannot be characterised as technical services. (Endemol South Africa (Proprietary) Ltd. vs DCIT [2018] 98 taxmann.com 227 (Mum ITAT))

- Technical Services like managerial and Consultancy service would denote seeking of services to cater to the special needs of the consumer-user as may be felt necessary and the making of the same available by the service provider. It is the above feature that would distinguish or identify a service provided from a facility offered. While the former is special and exclusive to the seeker of the service, the latter, even if termed as a service, is available to all and would therefore stand out in distinction to the former. (CIT vs Kotak Securities Ltd. [2016] 67 taxmann.com 356)

- The words ‘technical services’ is preceded by the word ‘managerial’ and succeeded by the word ‘consultancy’. It cannot be read in isolation as it takes colour from the words ‘managerial and ‘consultancy’ between which it is sandwiched. In this case principle of ‘noscitur a sociis’gets attracted. Coupling of the words together shows that they are to be understood in the same sense. The phrase managerial and consultancy is a definite indicative of the involvement of human element. The word ‘rendering of’ used here again signifies through human skill or experience. Therefore, the phrase ‘rendering of technical services’ has to be construed in the same sense involving direct human involvement without which technical services cannot be rendered. (Reliance Communications Ltd. vs ACIT [2016] 69 taxmann.com 307 ITAT Mumbai)

- The expression technical service would have reference to only technical service rendered by a human being. It would not include any service provided by machines or robots. (DDIT (International Taxation) vs Avavya Global Connect Ltd. [2011] 43 SOT 439)

- Consultancy Services would mean something akin to advisory services pursuant to deliberation between parties. (CIT vs Grup Ism (P) Ltd. [2015] 278 CTR 194 (Delhi))

- The term consultancy services, in common parlance, means providing advice or advisory services by a professional. Usually consultancy services are professional services requiring specialized qualification, knowledge, expertise of a professional person, and are more dependent on skill, intellect and individual characteristics of the person rendering it. (Endemol South Africa (Proprietary) Ltd. vs DCIT [2018] 98 taxmann.com 227 (Mum ITAT))

Significance of Make Available Clause

- In some treaties there is make available clause in Article 12/13 which mandates that services should “make available” technical knowledge, experience, skill, know how or processes. The term make available has far reaching significance since it limits scope of FTS. This clause is generally available in tax treaties with developed countries which want to retain the exclusive rights for taxing the transaction where there is no transfer or dissemination of knowledge or skill involved.

- The expression “make available” is used in the sense of one person supplying or transferring or imparting technical knowledge or technology to another.

- Technology is considered made available when the service recipient is enabled to absorb and apply the technology contained therein without the help of service provider in the future. In other words, technology, know-how, knowledge etc. is considered to be made available when the service receiver is able to use such technology, know-how, knowledge etc. as owner independently in future work without recourse to the service provider.

Illustrative list of services/transactions to be covered under different limbs of FTS (i.e Technical, Managerial and Consultancy Services)

| Technical | Managerial | Consultancy |

| Architectural Services | Human resource development | Advising in development of business strategies |

| Feasibility and Project report | Overall management, supervision and direction | Advising and assisting in development of information systems |

| Customization/modification of software | Overseeing operations/functions | Locating new business opportunities |

| Provision of technical assistance in preparation of drawings or designs | Managing financial operations | Supply of skilled labour by an employment agency |

| Provision of consulting and engineering services in the preparation technical design | Building relationship with vendors and seeking their feedback | Conducting market surveys |

| Fabrication of item on job work basis | Supplier development and material management | Project management services |

| Rendering technical assistance in preparation of project report | Development and administration of dealers, sales and marketing services | Liasing and coordination services |

| Geological Surveys | Legal and Financial advisory |

| Seismic Survey | Services by an umpire or match refree |

| Inspection and Testing services | Advise on production related problems |

| Quality Check Certifications |

| R & D Services |

| Repair and Maintenance (including preventive maintenance) |

| Maintenance of Software (including preventive maintenance) |

| Services involving specialized knowledge, experience and skill in construction operations |

For any query, suggestions or opinions, please feel free to reach out at [email protected]

Disclaimer: The above analysis of FTS is done on the basis of available law provisions and judicial precedents as on 02.04.2019, any subsequent amendment will change the scenario accordingly. This article is written for understanding purpose only and it not contains any opinion.